Portfolio Amount

Clients

AMC

Average Profit

ABOUT US

Flip COIN INVESTMENT

Flip Coin Investments (FCI) is a first of its kind Financial Consultant service provider based out of Bangalore which aims at providing personalized, innovative and profitable Financial Solutions for our Clients who have dynamic needs with their investments. We personally focus on providing tailor-made services based on financial goals of clients. We believe in quality and ensure that our clients are provided with all possible option to invest with confidence. Our aim is to progress with our customers to fulfill their financial goals.

Flip Coin Investments has a team of qualified professionals which include certified financial planners and investment advisers. We are distinct by our commitment in delivering excellent services, always of the highest quality to our clients.

WHY CHOOSE US

Invest with a calculated mind, benefit with wealth

Integrated and transparent services

We value integrity and transparency in clients' transactions and provide the best value for money to our clients. Our dedicated relationship managers are trained to provide excellent services and complete satisfaction to all their clients

All services under one umbrella

We are offering wide range of specialized and customized services in Stock, Futures & Options, IPO & Mutual Fund Distribution, Life / Health / General Insurance, Financial Planning, Portfolio Management, Tax advisory etc.

Accurate and timely research

We are always endeavored to provide timely research-based advice to our clients. Our research team comprises of experienced Fundamental, Technical and Derivative Strategies analysts.

Services

PORTFOLIO MANAGEMENT SERVICES

It involves a customized approach to investing based on the client's financial goals, risk tolerance, and investment preferences. PMS tailors an investment strategy to meet the specific needs and objectives of the client. Portfolio managers use diversification and asset allocation strategies to spread investments across different asset classes (stocks, bonds, etc.) and sectors. PMS typically requires a minimum investment amount. In essence, Portfolio Management Services is a comprehensive and individualized investment management solution where professional portfolio managers actively manage a client's investment portfolio to achieve specific financial goals and optimize returns based on the client's risk profile.

FINANCIAL PLANNING SERVICES

It involves a holistic approach to managing an individual's financial life. By addressing various aspects such as budgeting, investments, insurance, taxes, and estate planning, financial planners aim to create a comprehensive and tailored strategy that aligns with the client's financial aspirations and circumstances. At FCI, the financial planners work with clients to identify and define their financial goals. These goals can include buying a home, saving for education, planning for retirement, or building an emergency fund. We also educate clients about various financial concepts, investment options, and the potential risks and rewards associated with different financial decisions. This empowers clients to make informed choices about their finances.

TAX PLANNING SERVICES

Our team of qualified CA’s help clients minimize tax liabilities through strategies such as tax-efficient investing, utilizing tax-advantaged accounts, and taking advantage of available tax deductions. Effective tax planning is a year-round process. We provide ongoing guidance and updates to adapt to changes in tax laws, financial situations, or life circumstances.

INVESTMENT ADVISORY SERVICES

Investment advisory services are designed to provide professional guidance and expertise with regards to the stock market and other investment instruments. The ultimate goal is to help clients achieve their financial objectives while managing risk and maintaining a diversified and well-aligned investment strategy.

Why Modern Investments

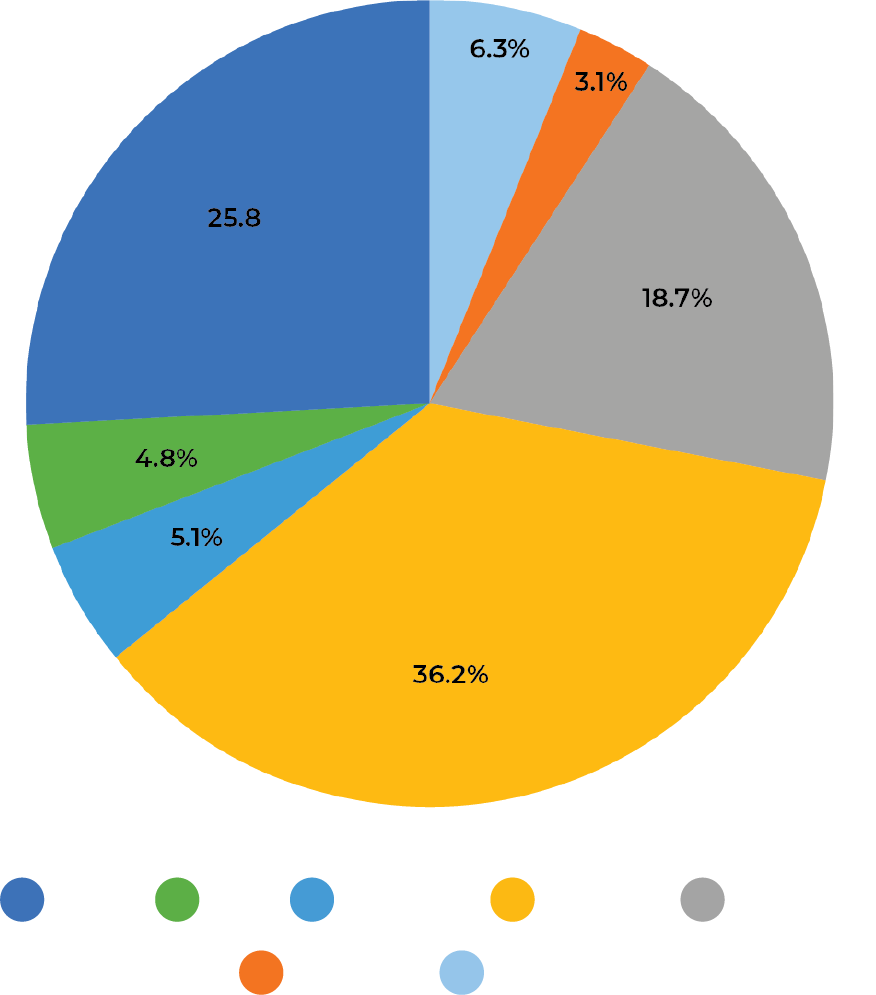

"This pie chart represents current investment scenario out of the total population of India."

| Funds | Percentage |

|---|---|

| MUTUAL FUNDS DATA | 6.3% |

| STOCK MARKET DATA | 3.1% |

| FIXED DEPOSIT | 18.7% |

| INSURANCE | 36.2% |

| REAL ESTATE | 5.1% |

| GOLD | 4.8% |

| OTHERS | 25.8% |